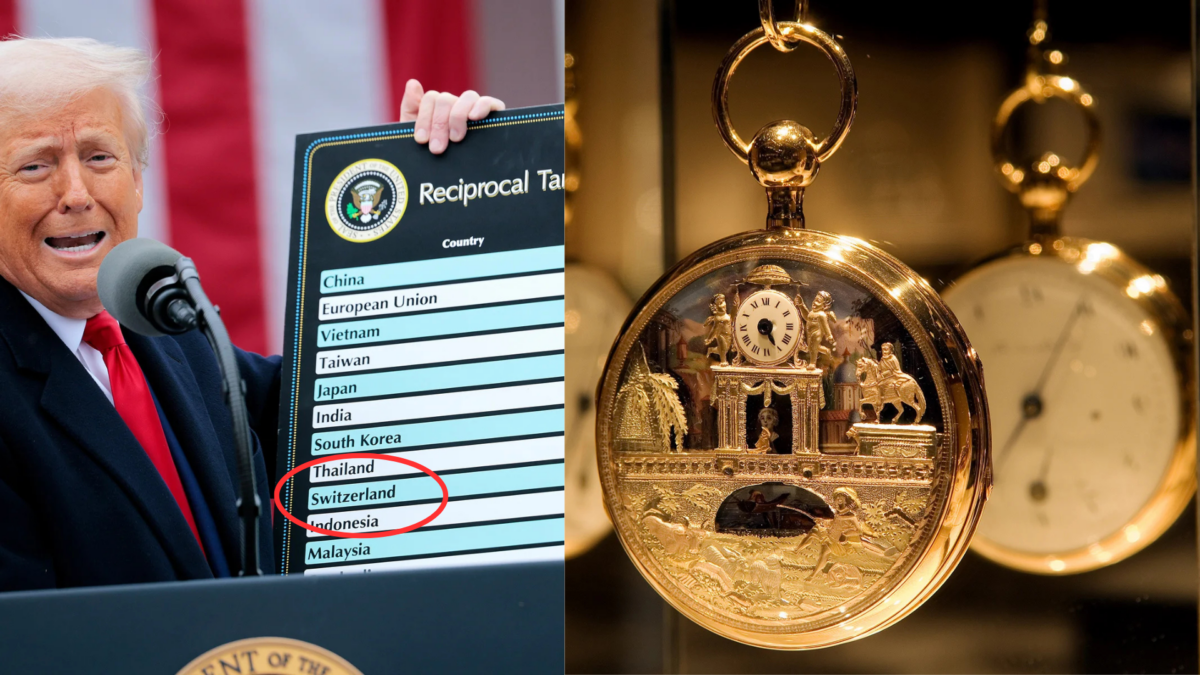

The Swiss watch industry is now ticking to a more anxious rhythm.

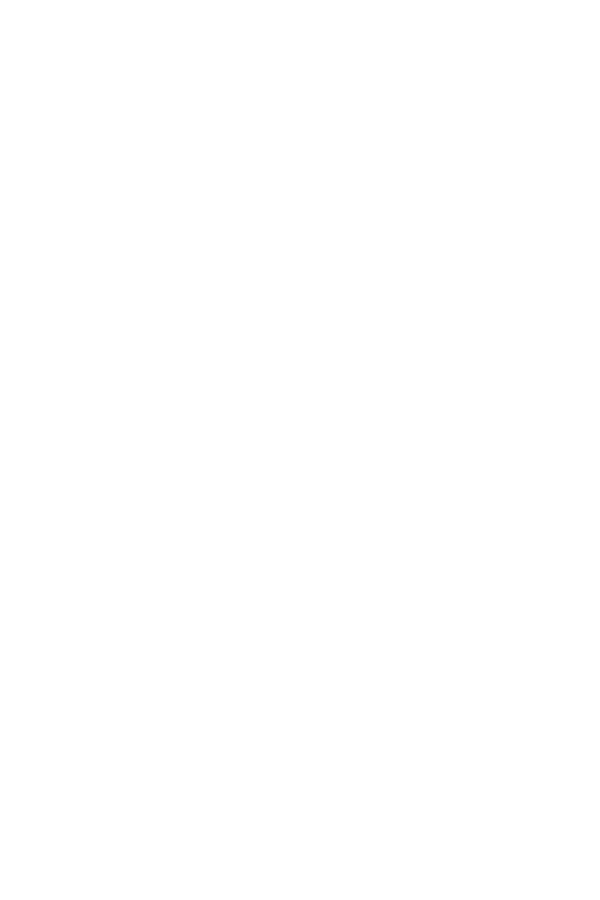

President Donald Trump’s 3rd of April’s decision to slap a hefty 31% tariff on Swiss imports has sent shockwaves through the horology world. This move not only threatens to inflate the price tags of coveted timepieces but also casts a shadow over the industry’s future in the U.S. market. Sounds intense right ? Well, it is, and it’s definitely not an April Fool’s joke.

Imagine eyeing that sleek Rolex Submariner, previously priced at $10,000. With the new tariff, you’re looking at an additional $3,100, pushing the pre-tax price to $13,100. Add state sales tax, and your dream watch now demands over $14,000 from your wallet. As Business Insider succinctly puts it, “Buying a Rolex is about to get more expensive.”

Rolex is obviously just an example to simplify the urgency of the matter to the newcomers. But the reality is actually worse when you look at it from other smaller brands’ perspectives. More on that later.

The United States isn’t just another market for Swiss watches; it’s the crown jewel, accounting for 16.8% of exports, translating to a substantial 4.4 billion Swiss francs. A 31% tariff could dampen American enthusiasm, leading to decreased sales and a potential reshuffling of global market dynamics.

To the Swiss, the mood among watchmakers is a blend of concern and contemplation. At the recent Watches and Wonders show in Geneva, the atmosphere was palpably tense. Many brands chose silence over speculation, underscoring the uncertainty ahead. Hodinkee wrote a good article about CEOs’ potential reactions, check it out here.

Speaking of CEOs, luxury conglomerates are bracing for impact. Richemont (Vacheron Constantin, JLC…) and Swatch Group (Breguet, Omega…), both heavily invested in the U.S. market, anticipate financial strains. Analyst Luca Solca from Bernstein Research predicts a 2% contraction in luxury growth for 2025, citing tariff pressures.

The politics of it ?

The tariff tiff isn’t confined to Switzerland. President Trump has also targeted the European Union with a 20% tariff and the U.K. with 10%. In retaliation, French President Emmanuel Macron is rallying European companies to reconsider U.S. investments, emphasizing the need for a united front. In smaller, much clearer words: Separations. A cold tariff war.

While luxury brands have historically wielded pricing power, the current scenario tests their limits. The resilience of the Swiss watch industry will hinge on strategic pricing, market diversification, and perhaps a dash of diplomatic finesse. As the hands of time move forward, the industry watches and waits, hoping that this tariff tempest will soon pass.

But on the other hand, big watch brands will certainly be forced to rethink their pricing. A positive scenario would be decreasing marketing budgets, which as we know is everything some of these companies care about, in order to stop inflating prices. Tariffs impact the buyer not the seller. But they start damaging the seller the moment there’s no buyer. I’m obviously trying to simplify this as much as possible without any BBC lingo.

What does this mean to Horology enthusiasts and smaller watchmakers ?

Not to catastrophize, but while we are already struggling with creativity, freedom of expression and lack of personality in the releases from major watch brands, the only place we could still look to for a drizzle of artistry is with the small independents. Emphasis on Independent.

My point is, it is actually VERY fair to say that these little sparks of light will be dimmed in no time. In other words, if they stick to their small production quantities and experimental designs, they will either:

1- Die. Or 2- Get acquired by luxury groups or private investment companies who will undoubtedly limit whatever creativity they were known for.

I was very moved by this news as you can tell, but I took my time before publishing this piece in order to have a much more realistic, unemotional view of the situation.

Did anything change ? Nop.

Do I still think that this is very sad ? Yes.

What’s the solution ?

Exploring other markets. The Asian, Middle Eastern and African markets are in my opinion very overlooked. I seriously believe that these companies should take the chance to at least raise awareness of their products’ greatness and heritage. Why ? to get fresh, unbiased and potentially better clients than the ones they’ve been desperately trying to please in the U.S.

Image Credits:

https://www.theguardian.com/us-news/2025/apr/02/trump-new-tariffs-liberation-day

https://www.en-vols.com/en/inspirations-en/switzerland-places-watchmaking

https://english.news.cn/europe/20250402/e706aac8b62b4c44ab6420647cbd3b6e/c.html

SUBSCRIBE NOW AND NEVER MISS A THING !